On February 28, 2023 on the website of the Court of Justice of the European Union (CJEU) the interesting judgment of the CJEU in Case C-695/20, Fenix International Ltd versus Commissioners for Her Majesty’s Revenue and Customs, ECLI:EU:C:2023:127, was published.

Introduction

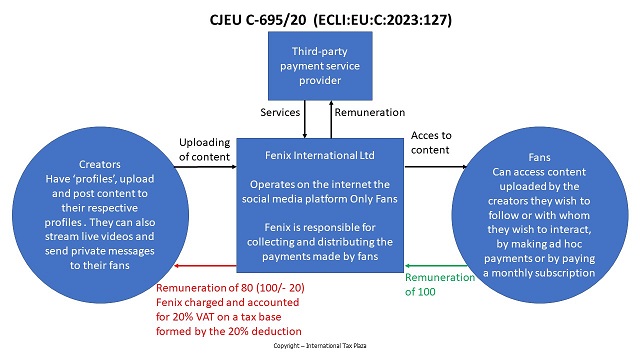

Fenix International (‘Fenix’), a company registered in the United Kingdom for VAT purposes, operates on the internet a social media platform known as Only Fans (‘the Only Fans platform’). That platform is offered to ‘users’ throughout the world, who are divided into ‘creators’ and ‘fans’. Fenix provides not only the Only Fans platform but also the device enabling the collection and distribution of the payments made by fans. Fenix levies 20% on any sum paid to a creator to whom it charges the corresponding amount. On the sum which it levies in this way, Fenix applies VAT at a rate of 20%, which appears on the invoices which it issues.

The UK tax and customs authority (HMRC) sent Fenix VAT assessments for the VAT due for a period between 2017 and 2020, taking the view that Fenix had to be deemed to be acting in its own name and consequently had to pay VAT on all of the sum received from a fan and not only on the 20% of that sum which it levied by way of remuneration.

Fenix filed an appeal before a UK court. By that appeal, Fenix essentially challenges the validity of the legal basis for the tax assessments, namely a provision of an implementing regulation of the Council of the European Union seeking to clarify the VAT directive. The court hearing the case brought by Fenix referred a question for a preliminary ruling to the Court of Justice before the end of the transition period following Brexit, so that the Court remains competent to respond to that question. The referring court seeks to ascertain whether the contested provision is invalid in so far as the Council may have supplemented or amended the VAT Directive, thus exceeding the implementing powers conferred on it.

The dispute in the main proceedings and the question referred for a preliminary ruling

19 Fenix, a company registered for VAT purposes in the United Kingdom, operates on the internet a social media platform known as Only Fans (‘the Only Fans platform’). That platform is offered to ‘users’ throughout the world, who are divided into ‘creators’ and ‘fans’.

20 Each creator has a ‘profile’ to which he or she uploads and publishes content, such as photos, videos and messages. Fans can access content uploaded by the creators they wish to follow or with whom they wish to interact, by making ad hoc payments or by paying a monthly subscription. Fans can also pay ‘tips’ or donations which do not give rise to the provision of any return content.

21 Each creator determines the amount of the monthly subscription, although Fenix sets the minimum amount payable both for subscriptions and for tips.

22 Fenix provides not only the Only Fans platform but also the device enabling financial transactions to be carried out. Fenix is responsible for collecting and distributing the payments made by fans, using a third-party entity which supplies payment services. Fenix also sets the general terms and conditions for use of the Only Fans platform.

23 Fenix levies 20% on any sum paid to a creator to whom it charges the corresponding amount. On the sum which it levies in this way, Fenix applies VAT at a rate of 20%, which appears on the invoices which it issues.

24 All payments appear on the relevant fan’s bank statement as payments made to Fenix.

25 On 22 April 2020, HMRC sent Fenix VAT assessments for the VAT due for the months of July 2017 to January 2020 and April 2020, taking the view that Fenix had to be deemed to be acting in its own name pursuant to Article 9a(1) of Implementing Regulation No 282/2011. Consequently, HMRC took the view that Fenix had to pay VAT on all of the sum received from a fan and not only on the 20% of that sum which it levied by way of remuneration.

26 On 27 July 2020, Fenix filed an appeal before the First-tier Tribunal (Tax Chamber) (United Kingdom), which is the referring court. By that appeal, Fenix essentially challenges the validity of the legal basis for the tax assessments, namely Article 9a of Implementing Regulation No 282/2011, and their respective amounts.

27 Before the referring court, Fenix claims that Article 9a of Implementing Regulation No 282/2011 has the effect of amending and/or supplementing Article 28 of the VAT Directive by adding new rules to it. Article 9a(1) of Implementing Regulation No 282/2011 goes beyond Article 28 of the VAT Directive by providing that an agent who takes part in a supply of services by electronic means is to be deemed to have received and supplied those services, even though the identity of the provider, who is the principal, is known. Such a provision deprives the parties of their contractual autonomy and disregards commercial and economic reality. It fundamentally alters the liability of the agent in the field of VAT by transferring the tax burden on platforms operated on the internet, since it proves impossible, in practice, to rebut the presumption laid down in the third subparagraph of Article 9a(1) of Implementing Regulation No 282/2011. Consequently, according to Fenix, Article 9a goes beyond the limits of the implementing powers conferred on the Council under Article 397 of the VAT Directive.

28 The referring court harbours doubts as to the validity of Article 9a of Implementing Regulation No 282/2011.

29 Relying on the judgment of 15 October 2014, Parliament v Commission, C‑65/13, EU:C:2014:2289), the referring court states that a provision to implement a legislative act is lawful only if that provision complies with the essential general aims pursued by that act, is necessary or appropriate for its implementation and does not amend or supplement it, even as to its non-essential elements. Although Article 9a of Implementing Regulation No 282/2011 is deemed to constitute a measure implementing Article 28 of the VAT Directive, it could nevertheless be argued that, by adopting Article 9a, the Council disregarded the implementing power conferred on it.

30 In particular, the referring court submits that the presumption established in Article 9a(1) of Implementing Regulation No 282/2011 could apply to all taxable persons involved in the supply of services, which constitutes not a technical measure but a radical change to the legal framework resulting from Article 28 of the VAT Directive. In addition, the presumption established in Article 9a(1) of that implementing regulation, and more particularly that set out in the third subparagraph of that provision, appears to remove the obligation to examine specifically the economic and commercial position of the taxable person, which arises, however, from Article 28 of the VAT Directive, as clarified by the Court in the judgment of 14 July 2011, Henfling and Others (C‑464/10, EU:C:2011:489).

31 In those circumstances the First-tier Tribunal (Tax Chamber) decided to stay the proceedings and to refer the following question to the Court of Justice for a preliminary ruling:

‘Is Article 9a of [Implementing Regulation No 282/2011] invalid on the basis that it goes beyond the implementing power or duty on the Council established by Article 397 of [the VAT Directive] in so far as it supplements and/or amends Article 28 of [that directive]?’

Judgment

The CJEU (Grand Chamber) ruled as follows:

The examination of the question referred has disclosed no factor of such a kind as to affect the validity of Article 9a(1) of Council Implementing Regulation (EU) No 282/2011 of 15 March 2011 implementing Directive 2006/112/EC on the common system of value added tax, as amended by Council Implementing Regulation (EU) No 1042/2013 of 7 October 2013, in the light of Articles 28 and 397 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax, as amended by Council Directive (EU) 2017/2455 of 5 December 2017, and of Article 291(2) TFEU.

Legal context

The Withdrawal Agreement

3 By its Decision (EU) 2020/135 of 30 January 2020 on the conclusion of the Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community (OJ 2020 L 29, p. 1; ‘the Withdrawal Agreement’), the Council of the European Union approved, on behalf of the European Union and the European Atomic Energy Community (EAEC), that agreement which was attached to that decision (OJ 2020 L 29, p. 7).

4 Article 86 of the Withdrawal Agreement, entitled ‘Pending cases before the Court of Justice of the European Union’, provides in paragraphs 2 and 3:

‘2. The Court of Justice of the European Union shall continue to have jurisdiction to give preliminary rulings on requests from courts and tribunals of the United Kingdom made before the end of the transition period.

3 For the purposes of this Chapter, proceedings shall be considered as having been brought before the Court of Justice of the European Union, and requests for preliminary rulings shall be considered as having been made, at the moment at which the document initiating the proceedings has been registered by the registry of the Court of Justice …’

5 In accordance with Article 126 of the Withdrawal Agreement, the transition period started on the date of entry into force of that agreement and ended on 31 December 2020.

The VAT Directive

6 Having regard to the date of the VAT assessments at issue in the dispute in the main proceedings, that dispute is governed by the provisions of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax (OJ 2006 L 347, p. 1), as amended by Council Directive (EU) 2017/2455 of 5 December 2017 (OJ 2017 L 348, p. 7) (‘the VAT Directive’).

7 Recitals 61 to 64 of the VAT Directive are worded as follows:

‘(61) It is essential to ensure uniform application of the VAT system. Implementing measures are appropriate to realise that aim.

(62) Those measures should, in particular, address the problem of double taxation of cross-border transactions which can occur as the result of divergences between Member States in the application of the rules governing the place where taxable transactions are carried out.

(63) Although the scope of the implementing measures would be limited, those measures would have a budgetary impact which for one or more Member States could be significant. Accordingly, the Council is justified in reserving to itself the right to exercise implementing powers.

(64) In view of their limited scope, the implementing measures should be adopted by the Council acting unanimously on a proposal from the [European] Commission.’

8 Title IV of that directive, entitled ‘Taxable transactions’, contains Chapter 3, relating to the ‘supply of services’, in which Article 28 appears.

9 Article 28 of the VAT Directive provides:

‘Where a taxable person acting in his own name but on behalf of another person takes part in a supply of services, he shall be deemed to have received and supplied those services himself.’

10 Title V of that directive, entitled ‘Place of taxable transactions’, includes Chapter 3, relating to the ‘place of supply of services’. Section 3 of that chapter lists, in its nine subsections, various types of services, including, in Subsection 8, since 1 January 2015, the supply of telecommunications, broadcasting and electronic services to a non-taxable person. That subsection consists of Article 58 of that directive, which provides, in paragraph 1 thereof, that those services are taxable in the Member State where that person is established or has his or her permanent address or usually resides.

11 That subsection had been amended, with effect from 1 January 2015, by Council Directive 2008/8/EC of 12 February 2008 (OJ 2008 L 44, p. 11), recital 1 of which states that ‘the realisation of the internal market, globalisation, deregulation and technology change have all combined to create enormous changes in the volume and pattern of trade in services. It is increasingly possible for a number of services to be supplied at a distance. …’.

12 Article 220 of the VAT Directive provides:

‘Every taxable person shall ensure that, in respect of the following, an invoice is issued, either by himself or by his customer or, in his name and on his behalf, by a third party:

(1) supplies of goods or services which he has made to another taxable person or to a non-taxable legal person;

…’

13 Under Article 226 of that directive:

‘Without prejudice to the particular provisions laid down in this Directive, only the following details are required for VAT purposes on invoices issued pursuant to Articles 220 and 221:

…

(5) the full name and address of the taxable person and of the customer;

(6) the quantity and nature of the goods supplied or the extent and nature of the services rendered;

…’

14 Article 397 of that directive provides:

‘The Council, acting unanimously on a proposal from the Commission, shall adopt the measures necessary to implement this Directive.’

Implementing Regulation No 282/2011

15 Recitals 2, 4 and 5 of Implementing Regulation No 282/2011 are worded as follows:

‘(2) [The VAT Directive] contains rules on [VAT] which, in some cases, are subject to interpretation by the Member States. The adoption of common provisions implementing [the VAT Directive] should ensure that application of the VAT system complies more fully with the objective of the internal market, in cases where divergences in application have arisen or may arise which are incompatible with the proper functioning of such internal market. These implementing measures are legally binding only from the date of the entry into force of this Regulation and are without prejudice to the validity of the legislation and interpretation previously adopted by the Member States.

…

(4) The objective of this Regulation is to ensure uniform application of the current VAT system by laying down rules implementing [the VAT Directive], in particular in respect of taxable persons, the supply of goods and services, and the place of taxable transactions. In accordance with the principle of proportionality as set out in Article 5(4) of the Treaty on European Union, this Regulation does not go beyond what is necessary in order to achieve this objective. Since it is binding and directly applicable in all Member States, uniformity of application will be best ensured by a Regulation.

(5) These implementing provisions contain specific rules in response to selective questions of application and are designed to bring uniform treatment throughout the Union to those specific circumstances only. They are therefore not conclusive for other cases and, in view of their formulation, are to be applied restrictively.’

16 Article 1 of that Implementing Regulation No 282/2011 provides:

‘This Regulation lays down measures for the implementation of certain provisions of Titles I to V … of [the VAT Directive].’

17 Recitals 1 and 4 of Implementing Regulation No 1042/2013, which amended Implementing Regulation No 282/2011 with effect from 1 January 2015, state:

‘(1) [The VAT Directive] provides that as from 1 January 2015, all telecommunications, radio and television broadcasting and electronically supplied services supplied to a non-taxable person are to be taxed in the Member State in which the customer is established, has his permanent address or usually resides, regardless of where the taxable person supplying those services is established. Most other services supplied to a non-taxable person continue to be taxed in the Member State in which the supplier is established.

…

(4) It is necessary to specify who is the supplier for [VAT] purposes where electronically supplied services, or telephone services provided through the internet, are supplied to a customer through telecommunications networks or via an interface or a portal.’

18 Under Article 9a of Implementing Regulation No 282/2011, inserted by Implementing Regulation No 1042/2013:

‘1. For the application of Article 28 of [the VAT Directive], where electronically supplied services are supplied through a telecommunications network, an interface or a portal such as a marketplace for applications, a taxable person taking part in that supply shall be presumed to be acting in his own name but on behalf of the provider of those services unless that provider is explicitly indicated as the supplier by that taxable person and that is reflected in the contractual arrangements between the parties.

In order to regard the provider of electronically supplied services as being explicitly indicated as the supplier of those services by the taxable person, the following conditions shall be met:

(a) the invoice issued or made available by each taxable person taking part in the supply of the electronically supplied services must identify such services and the supplier thereof;

b) the bill or receipt issued or made available to the customer must identify the electronically supplied services and the supplier thereof.

For the purposes of this paragraph, a taxable person who, with regard to a supply of electronically supplied services, authorises the charge to the customer or the delivery of the services, or sets the general terms and conditions of the supply, shall not be permitted to explicitly indicate another person as the supplier of those services.

2. Paragraph 1 shall also apply where telephone services provided through the internet, including voice over internet Protocol (VoIP), are supplied through a telecommunications network, an interface or a portal such as a marketplace for applications and are supplied under the same conditions as set out in that paragraph.

3. This Article shall not apply to a taxable person who only provides for processing of payments in respect of electronically supplied services or of telephone services provided through the internet, including voice over internet Protocol (VoIP), and who does not take part in the supply of those electronically supplied services or telephone services.’

From the considerations of the Court

The jurisdiction of the Court

32 It follows from Article 86(2) of the Withdrawal Agreement, which entered into force on 1 February 2020, that the Court remains competent to give a preliminary ruling on the requests of United Kingdom courts made before the end of the transition period fixed, in accordance with Article 126 of that agreement, at 31 December 2020. Moreover, under Article 86(3) of that agreement, a request for a preliminary ruling is to be considered as having been made, within the meaning of paragraph 2 of that article, on the date on which the document initiating the proceedings has been registered by the registry of the Court of Justice.

33 In the present case, the request for a preliminary ruling, made by a United Kingdom court, was registered by the Court Registry on 22 December 2020, that is to say before the end of the transition period.

34 It follows that the Court has jurisdiction to give a preliminary ruling on that request.

Consideration of the question referred

35 By its question, the referring court seeks, in essence, to ascertain whether Article 9a(1) of Implementing Regulation No 282/2011 is invalid in so far as the Council supplemented or amended Article 28 of the VAT Directive, thus exceeding the implementing powers conferred on it by Article 397 of that directive, pursuant to Article 291(2) TFEU.

Preliminary observations

36 In the first place, it should be borne in mind that, under Article 291(1) TFEU, it is for the Member States to implement legally binding Union acts. However, under Article 291(2) TFEU, where uniform conditions for implementing legally binding Union acts are needed, those acts are to confer implementing powers on the Commission, or, in duly justified specific cases and in the cases provided for in Articles 24 and 26 TEU, on the Council.

37 With regard more specifically to this requirement to duly justify the conferral of such implementing powers on the Council, the Court has already found that Article 291(2) TFEU requires a detailed statement of the reasons why that institution is entrusted with the adoption of measures implementing a legally binding act of the Union (see, to that effect, judgment of 1 March 2016, National Iranian Oil Company v Council, C‑440/14 P, EU:C:2016:128, paragraphs 49 and 50 and the case-law cited).

38 In the present case, Article 397 of the VAT Directive confers on the Council an implementing power within the meaning of Article 291(2) TFEU. Article 397 provides that the Council, acting unanimously on a proposal from the Commission, is to adopt the measures necessary to implement the VAT Directive.

39 In that regard, it follows from recitals 61 to 63 of the VAT Directive that the EU legislature considered that, first, it was necessary for measures implementing that directive to be uniform, in particular in order to address the problem of double taxation of cross-border transactions which can occur as the result of divergences between Member States in the application of the rules governing the place where taxable transactions are carried out, and, second, it was appropriate to reserve to the Council the right to adopt such implementing measures on account of the impact, sometimes significant, that such measures could have on the budgets of Member States.

40 Those grounds justify the Council’s authorisation, under Article 397 of the VAT Directive, to adopt the measures necessary for the implementation of that directive, including Article 9a(1) of Implementing Regulation No 282/2011, which is specifically intended to ensure the uniform application of Article 28 of that directive.

41 In the second place, as regards the limits of the implementing powers referred to in Article 291(2) TFEU, it should be recalled that the adoption of the essential rules of a matter, such as VAT, is reserved to the EU legislature. It follows that the provisions laying down the essential elements of the basic legislation, the adoption of which requires political choices falling within the responsibilities of that legislature, cannot be delegated or appear in implementing acts, referred to in Article 290 TFEU (see, to that effect, judgment of 10 September 2015, Parliament v Council, C‑363/14, EU:C:2015:579, paragraph 46 and the case-law cited).

42 Moreover, identifying the elements of a matter which must be categorised as essential must be based on objective factors amenable to judicial review, and requires account to be taken of the characteristics and particular features of the field concerned (judgment of 10 September 2015, Parliament v Council, C‑363/14, EU:C:2015:579, paragraph 47 and the case-law cited).

43 Consequently, where, by virtue of a legally binding EU act such as the VAT Directive, the Council has the power to adopt implementing measures, such as Article 9a(1) of Implementing Regulation No 282/2011, that institution cannot, within the context of such a power, adopt essential rules on the matter, since those rules must be adopted in compliance with the applicable legislative procedure, namely, as regards the VAT Directive, the special procedure established in Article 113 TFEU.

44 Furthermore, the Court has already held that, where implementing powers are conferred on the Commission, it is called upon to provide further detail in relation to the content of the legislative act in question, in order to ensure that it is implemented under uniform conditions in all the Member States. Accordingly, the provisions of an implementing act adopted by the Commission must, first, comply with the essential general aims pursued by the legislative act which those provisions are expected to clarify, and second, be necessary or appropriate for the uniform implementation of that act without supplementing or amending it, even as to its non-essential elements (see, to that effect, judgment of 15 October 2014, Parliament v Commission, C‑65/13, EU:C:2014:2289, paragraphs 43 to 46 and the case-law cited).

45 Those considerations relating to the limits of the Commission’s implementing powers are also valid where, pursuant to Article 291(2) TFEU, such powers are conferred on the Council.

46 First, it should be noted that, in referring both to the Commission and to the Council, Article 291(2) TFEU draws no distinction as to the nature and scope of the implementing powers on the basis of the institution on which they are conferred.

47 Second, it follows from the scheme of Articles 290 and 291 TFEU that the Council’s exercise of implementing powers cannot be governed by conditions different from those imposed on the Commission when it is called upon to exercise its implementing powers.

48 By distinguishing implementing acts from delegated acts, which only the Commission is empowered to adopt under the conditions laid down in Article 290 TFEU and which allow it to supplement or amend certain non-essential elements of an EU legislative act, Articles 290 and 291 TFEU ensure that, where the Council is entrusted by the EU legislature with the adoption of implementing acts, it does not have the powers reserved to the Commission in the context of the adoption of delegated acts. Therefore, the Council cannot, by means of implementing acts, supplement or amend the legislative act, even in its non-essential elements.

49 It follows from all those considerations that the implementing powers conferred on the Commission and the Council under Article 291(2) TFEU entail, in essence, the power to adopt measures which are necessary or appropriate for the uniform implementation of the provisions of the legislative act on the basis of which they are adopted and which merely specify the content of that act, in compliance with the essential general aims pursued by that act, without amending or supplementing it, in its essential or non-essential elements.

50 In particular, it must be held that an implementing measure merely specifies the provisions of the legislative act concerned where it is intended solely, in general or in certain specific cases, to clarify the scope of those provisions or to determine the detailed rules for their application, provided, however, that in so doing, that measure avoids any contradiction with the objectives of those provisions and does not in any way alter the normative content of that act or its scope of application.

51 Therefore, in order to determine whether, in adopting Article 9a(1) of Implementing Regulation No 282/2011, the Council complied with the limits of the implementing powers conferred on it, pursuant to Article 291(2) TFEU, by Article 397 of the VAT Directive, it is necessary to ascertain whether Article 9a(1) merely clarifies the content of Article 28 of that directive, which entails examining whether, first, Article 9a(1) respects the essential general objectives of that directive and, in particular, those of Article 28 thereof, second, it is necessary or appropriate for the uniform implementation of Article 28 and, third, neither it supplements nor amends Article 28 in any way.

Compliance of Article 9a of Implementing Regulation No 282/2011 with the essential general aims pursued by Article 28 of the VAT Directive

52 It should be noted, in the first place, that the VAT Directive seeks to establish a common system of VAT. For the purposes of a uniform application of that system, which is included in the aims of that directive, as in particular, recital 61 thereof underlines, the terms which define the scope of application of that directive, such as ‘taxable transactions’, ‘taxable persons’ and ‘economic activities’, must be interpreted in an autonomous and uniform manner (see, to that effect, judgment of 29 September 2015, Gmina Wrocław, C‑276/14, EU:C:2015:635, paragraph 26 and the case-law cited).

53 Under Article 28 of the VAT Directive, which comes under Title IV of that directive, entitled ‘Taxable transactions’, where a taxable person acting in his own name but on behalf of another person takes part in a supply of services, he shall be deemed to have received and supplied those services himself.

54 That article, which is worded in general terms, without containing restrictions as to its application or scope and which thus covers all categories of services, (see, to that effect, judgment of 14 July 2011, Henfling and Others, C‑464/10, EU:C:2011:489, paragraph 36) creates the legal fiction of two identical supplies of services provided consecutively under which the operator, who takes part in the supply of services and who constitutes the commission agent, is considered to have, first, received the services in question from the operator on behalf of whom it acts, who constitutes the principal, before providing, second, those services to the client himself or herself (judgment of 21 January 2021, UCMR – ADA, C‑501/19, EU:C:2021:50, paragraph 43 and the case-law cited).

55 Article 28 of the VAT Directive thus establishes that a taxable person who, in the context of a supply of services, acts as an intermediary in his or her own name but on behalf of another person, is presumed to be the supplier of those services.

56 In the second place, it is apparent from recitals 2, 4 and 5 of Implementing Regulation No 282/2011 that, in so far as the rules laid down in the VAT Directive are, in certain cases, subject to differences in their application between the Member States, which are incompatible with the proper functioning of the internal market, the objective of that implementing regulation is to ensure the uniform application of the current VAT system, by adopting implementing provisions of the VAT Directive as regards, inter alia, the supply of services, which must answer certain questions of application and be designed to provide uniform treatment throughout the European Union of only those particular cases which are regulated there.

57 As regards, more specifically, Article 9a(1) of Implementing Regulation No 282/2011, introduced by Implementing Regulation No 1042/2013, it follows from recitals 1 and 4 of the latter regulation that, having regard to the development which, in the context of the VAT Directive, characterises, inter alia, the taxation of electronically supplied services to a non-taxable person, which are, from 1 January 2015, taxable in the Member State where the customer is established, has his or her permanent address or usually resides, regardless of where the taxable person supplying those services is established, the Council considered it necessary to clarify who the supplier of services for VAT purposes is when those services are supplied through a telecommunications network, an interface or a portal.

58 It is in that context that Article 9a(1) of Implementing Regulation No 282/2011 states, ‘for the application of Article 28 of [the VAT Directive]’ and where electronically supplied services are supplied through a telecommunications network, an interface or a portal such as a marketplace for applications, under what conditions the taxable person, who takes part in that supply, acts in his or her own name but on behalf of the provider.

59 In so doing, Article 9a(1) of Implementing Regulation No 282/2011 is intended to ensure, from 1 January 2015, the uniform application of the presumption established in Article 28 of the VAT Directive with regard to such taxable persons and, thus, of the common system of VAT established by that directive, to the services referred to in that Article 9a(1), which fall within the scope of Article 28, which covers, as is apparent from paragraph 54 of the present judgment, all categories of services.

60 It follows that the provisions of Article 9a(1) of Implementing Regulation No 282/2011 comply with the essential general aims of the VAT Directive and, in particular, those of Article 28 thereof.

Whether Article 9a(1) of Implementing Regulation No 282/2011 is necessary or appropriate for the uniform implementation of Article 28 of the VAT Directive

61 It should be noted that it follows from, inter alia, the explanatory memorandum to the Commission’s proposal for a Council Regulation amending Implementing Regulation No 282/2011 as regards the place of supply of services (COM(2012) 763 final), which gave rise to the introduction of Article 9a into that implementing regulation, that, in the light of the changes made in the VAT Directive from 1 January 2015 with regard to the place of taxation of certain supplies of services, including telecommunications and electronic services, it had become essential, in order to ensure legal certainty for service providers and to avoid double taxation or non-taxation which would have resulted from divergent implementation arrangements between Member States, to amend that implementing regulation in order to establish the manner in which the relevant provisions of the VAT Directive should be applied.

62 In those circumstances, it is necessary to consider that Article 9a(1) of Implementing Regulation No 282/2011 is appropriate, or even necessary, for the uniform implementation of Article 28 of the VAT Directive.

Compliance of Article 9a(1) of Implementing Regulation No 282/2011 with the prohibition on supplementing or amending the content of Article 28 of the VAT Directive

63 According to Fenix, the three subparagraphs of Article 9a(1) of Implementing Regulation No 282/2011 supplement or amend Article 28 of the VAT Directive, with the result that they disregard the limits of the implementing power conferred on the Council.

64 First of all, as regards the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, Fenix takes the view, first, that the EU legislature did not intend to regulate, in Article 28 of the VAT Directive, the question of the cases in which a taxable person who takes part in the supply of services acts in his or her own name but on behalf of another person, which the Council cannot remedy, unless it exceeds its powers, by means of an implementing measure. Second, according to Fenix, the presumption established in the first subparagraph of Article 9a(1) applies without regard to the contractual and commercial reality, contrary to the case-law of the Court, and radically alters the liability of the agent in the field of VAT.

65 In that regard, it must be borne in mind that, under the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, a taxable person taking part in the supply of electronically supplied services through a telecommunications network, an interface or a portal such as a marketplace for applications, is to be ‘presumed to be acting in his own name but on behalf of the provider of those services unless that provider is explicitly indicated as the supplier by that taxable person and that is reflected in the contractual arrangements between the parties’.

66 It is in no way apparent from the VAT Directive that the EU legislature refrained from ensuring, if necessary, by conferring implementing powers on the Council pursuant to Article 397 of that directive, a uniform application of the conditions referred to in Article 28 of that directive, in particular the condition that, in order to be regarded as the supplier of a service, the taxable person taking part in that supply must act in his or her own name but on behalf of another person. That is all the more so since that condition is crucial to the implementation of the presumption established in Article 28 of the VAT Directive and, consequently, for the uniform application of the common system of VAT, which is included, as noted in paragraph 52 above, among the objectives of that directive.

67 As regards, more specifically, the question as to whether the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, as drafted by the Council, supplements or amends the content of Article 28 of the VAT Directive, it should be noted, first, that the fact that Article 9a(1) concerns, as stated in paragraph 59 of the present judgment, only some of the services referred to in Article 28 of the VAT Directive, and thus certain specific cases, does not in any way preclude, as follows from paragraph 50 of the present judgment, considering that Article 9a(1) to be a mere clarification of the content of Article 28.

68 Second, in so far as the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 provides that a taxable person taking part in the supply of electronically supplied services is ‘presumed to act in his own name but on behalf of the provider of those services’, it must be held that that provision merely specifies the cases in which the condition relating to the scope ratione personae of Article 28 of the VAT Directive, which is necessary for the application of the presumption referred to in that article, is to be regarded as satisfied, without supplementing or amending the content of that article.

69 In particular, the presumption in the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 is fully in line with the logic underlying Article 28 of the VAT Directive. As the Advocate General observed in point 75 of his Opinion, even before the adoption of that Article 9a, the purpose of Article 28 of the VAT Directive was to transfer liability to pay VAT as regards supplies of services in which a taxable person acting in his or her own name but on behalf of another person takes part.

70 Therefore, the presumption in the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 does not alter the nature of the presumption laid down in Article 28 of the VAT Directive, but is limited, by fully integrating it, to giving concrete expression to it in the specific context of the supply of electronically supplied services through a telecommunications network, an interface or a portal such as a marketplace for applications.

71 Third, by adding ‘unless that provider is explicitly indicated as the supplier by that taxable person and that is reflected in the contractual arrangements between the parties’, the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 allows that presumption to be rebutted, by taking into account the contractual reality of the relationship between the participants in the chain of economic transactions.

72 In that regard, it should be recalled that contractual agreements reflect, in principle, economic and commercial realities of transactions, the taking into account of which is a fundamental criterion for the application of the common system of VAT, so that the relevant contractual terms constitute a factor to be taken into consideration when the supplier and the recipient in a ‘supply of services’ transaction within the meaning of the VAT Directive have to be identified (see, to that effect, judgments of 20 June 2013, Newey, C‑653/11, EU:C:2013:409, paragraphs 42 and 43, and of 24 February 2022, Suzlon Wind Energy Portugal, C‑605/20, EU:C:2022:116, paragraph 58 and the case-law cited).

73 Thus the Court has already found that the condition relating to the fact that the taxable person must act in his or her own name, but on behalf of another, included in Article 28 of the VAT Directive, must be determined, in particular, on the basis of the contractual relations between the parties (see, to that effect, judgment of 14 July 2011, Henfling and Others, C‑464/10, EU:C:2011:489, paragraph 42).

74 It follows that, by providing, in the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, that the presumption that the taxable person referred to in that provision acts in his or her own name but on behalf of the provider of the services in question may be rebutted if it follows from the contractual agreements between the parties that the latter is explicitly indicated as the supplier of services, the Council merely clarified the normative content established by Article 28 of the VAT Directive, as interpreted by the Court, for the purposes of ensuring that that article is implemented under uniform conditions throughout the European Union.

75 Next, as regards the second subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, it should be noted that, according to that provision, two conditions must be satisfied ‘in order to regard the provider of electronically supplied services as being explicitly indicated as the supplier of those services by the taxable person’. First, the invoice issued or made available by each taxable person taking part in the supply of the electronically supplied services must identify such services and the supplier thereof. Second, the bill or receipt issued or made available to the customer must identify the electronically supplied services and the supplier thereof.

76 As the Advocate General noted, in essence, in point 76 of his Opinion, that provision has a close relationship with the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 and follows the same logic as the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, by setting out, in greater detail, the conditions relating to invoicing, in the light of which the provider of electronically supplied services is explicitly indicated by the taxable person as the supplier of those services.

77 The information which must appear, pursuant to Article 226(5) and (6) of the VAT Directive, on the invoice, a document which, in compliance with Article 220(1) of that Directive, any taxable person must ensure has been duly issued for any supply of services it carries out, in particular, to another taxable person (see, to that effect, judgment of 18 July 2013, Evita-K, C‑78/12, EU:C:2013:486, paragraph 49 and the case-law cited), is part of the elements that fall within the commercial and contractual relationships between the different parties which are supposed to reflect the economic and commercial reality of the transactions at issue. That information may thus make it possible to assess the relationship between the various operators involved in the supply of electronically supplied services.

78 Accordingly, the second subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 merely sets out the elements which make it possible to carry out a specific assessment, having regard to the need to take into account the economic and commercial reality of the transactions, the situations and the conditions in which the presumption, which results from the first subparagraph of that provision in accordance with that laid down in Article 28 of the VAT Directive, may be rebutted.

79 Relating, therefore, to the evidence enabling rebuttal of the presumption referred to in the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, the specific assessment of which is a matter for the tax authorities and courts of the Member States, the second subparagraph of Article 9a(1) cannot, as such and in the light of the findings in paragraphs 71 to 74 above, be regarded as supplementing or amending the normative framework established in Article 28 of the VAT Directive.

80 Finally, as regards the third subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, it should be recalled that, in accordance with that provision, ‘for the purposes of [that] paragraph, a taxable person who, with regard to a supply of electronically supplied services, authorises the charge to the customer or the delivery of the services, or sets the general terms and conditions of the supply, shall not be permitted to explicitly indicate another person as the supplier of those services’.

81 It thus follows from that third subparagraph that, where the taxable person is in one of the three situations covered by that subparagraph, the presumption in the first subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 cannot be rebutted and therefore becomes irrebuttable. In other words, in the case of the supply of electronically supplied services through a telecommunications network, an interface or a portal such as a marketplace for applications, a taxable person taking part in that supply is to be always presumed to be acting in his or her own name but on behalf of the provider of those services and, therefore, is deemed himself or herself to be the supplier of those services, when he or she authorises the charge to the customer or the delivery of those services or sets the general terms and conditions of that supply.

82 It must be held that, contrary to what Fenix claims, the Council took account, in adopting the third subparagraph of Article 9a(1) of that implementing regulation, of the economic and commercial reality of transactions, in the specific context of the supply of electronically supplied services through a telecommunications network, an interface or a portal, such as a marketplace for applications, as required, in accordance with the case-law cited in paragraph 73 of the present judgment, in Article 28 of the VAT Directive.

83 Where a taxable person, who takes part in the supply of a service by electronic means, by operating, for example, an online social network platform, has the power to authorise the supply of that service, or to charge for it, or to lay down the general terms and conditions of such a supply, that taxable person may unilaterally define essential elements relating to the supply, namely the provision of that service and the time at which it will take place, or the conditions under which the consideration will be payable, or the rules forming the general framework of that service. In such circumstances, and having regard to the economic and commercial reality reflected by them, the taxable person must be regarded as being the supplier of services, pursuant to Article 28 of the VAT Directive.

84 It is therefore clearly in accordance with Article 28 of the VAT Directive that, in the circumstances set out in the third subparagraph of Article 9a(1) of Implementing Regulation No 282/2011, such a taxable person cannot evade the presumption laid down in Article 28 by contractually designating another taxable person as the supplier of the services concerned. The latter provision cannot tolerate contractual terms which do not reflect economic and commercial reality.

85 The fact that the circumstances provided for in the third subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 are not mentioned in Article 28 of the VAT Directive is not capable of invalidating that analysis.

86 In the light of the considerations set out in paragraphs 50 and 82 to 84 of the present judgment, suffice it to note that, by expressly listing those circumstances, the third subparagraph of Article 9a(1) of Implementing Regulation No 282/2011 does not alter the normative content established by Article 28 of the VAT Directive but, on the contrary, merely gives specific expression to the application of that provision to the particular case of the services referred to in Article 9a(1) of that implementing regulation.

87 For similar reasons, the argument put forward by Fenix that it would be contrary to Article 28 of the VAT Directive to treat the taxable person referred to in that article as the supplier of services when the final customer is aware of the existence of the agreement between the principal and the agent and the identity of that principal cannot be accepted either.

88 In that regard, it is true that, in order for Article 28 of the VAT Directive to apply, there must be an agency in performance of which the agent acts, on behalf of the principal, in the supply of services (judgment of 12 November 2020, ITH Comercial Timişoara, C‑734/19, EU:C:2020:919, paragraph 51). However, even if, despite the complexity of the chains of transactions which may characterise the supply of electronically supplied services, the final customer is, in certain cases, in a position to know the existence of the agency and the identity of the principal, those circumstances are not sufficient in themselves to exclude that the taxable person, taking part in the supply of services, acts in his or her own name but on behalf of another person, within the meaning of Article 28 of the VAT Directive (see, to that effect, judgment of 14 July 2011, Henfling and Others, C‑464/10, EU:C:2011:489, paragraph 43). It is above all the powers enjoyed by that taxable person in the context of the supply of services in which he or she takes part which matter.

89 In those circumstances, like the first two subparagraphs of Article 9a(1) of Implementing Regulation No 282/2011, the third subparagraph of that provision cannot be regarded as supplementing or amending Article 28 of the VAT Directive.

90 Consequently, by adopting Article 9a(1) of Implementing Regulation No 282/2011, in order to ensure a uniform application in the European Union of Article 28 of the VAT Directive for the services referred to in that first provision, the Council did not exceed the implementing powers conferred on it by Article 397 of that directive, pursuant to Article 291(2) TFEU.

91 In the light of all the foregoing considerations, the answer to the question referred must be that examination of that question has disclosed no factor of such a kind as to affect the validity of Article 9a(1) of Implementing Regulation No 282/2011, in the light of Articles 28 and 397 of the VAT Directive and of Article 291(2) TFEU.

Costs

92 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the national court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)