- Details

On May 31, 2016 the OECD released a Public Discussion Draft titled: “BEPS ACTION 15 - Development of a Multilateral Instrument to Implement the Tax Treaty related BEPS Measures”. The OECD invites public comments on technical issues identified in the Discussion Draft.

Comments and input should be submitted by June 30, 2016 at the latest, and should be sent by email in Word format. In the Discussion Draft it is emphasized that comments should be focused solely on technical issues of implementation and on issues related to the development of a MAP arbitration provision, rather than on the scope of the provisions to be covered in the multilateral instrument or on the substance of the underlying BEPS outputs.

- Details

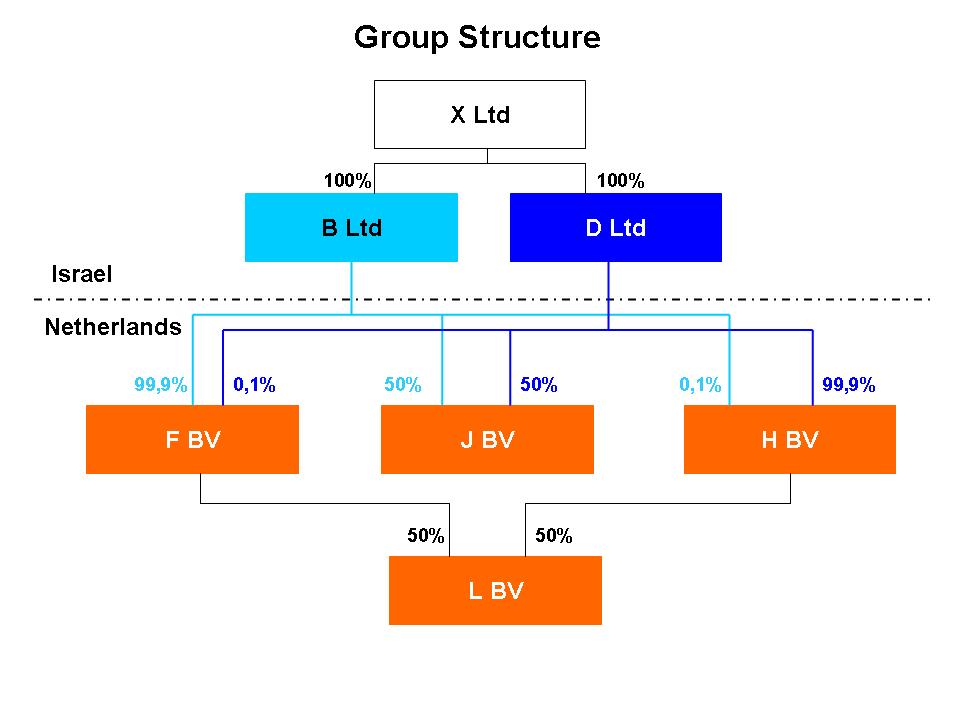

The situations in which the Dutch corporate income tax Act allows a group of entities to form a fiscal unity for Dutch corporate income tax purposes are limited. Two Dutch sister companies for example cannot form a fiscal unity without also including in that fiscal unity their Dutch parent company that owns at least 95% of the shares in both of these sister companies. The same goes if a foreign entity owns all the shares of two Dutch sister companies and these two Dutch sister companies would like to form a fiscal unity for Dutch corporate income tax purposes. Based on the text of the Dutch corporate income tax Act, these two sister entities cannot form a fiscal unity for Dutch corporate income tax purposes. Neither can they form cross-border fiscal unity which includes their foreign parent company (assuming that the shareholdings in the Dutch entities are not allocated to a Dutch permanent establishment of the foreign parent company).

- Details

Based on the overview of Jurisdictions Participating in the Convention on Mutual Administrative Assistance in Tax Matters as available on the website of the OECD on May 26, 2016 Uganda deposited its instrument of ratification, acceptance or approval for the OECD’s Multilateral Convention on Mutual Administrative Assistance in Tax Matters. Uganda signed the Convention on November 4, 2015.

- Details

On May 20, 2016 the Government of the Republic of Singapore and the Royal Government of Cambodia signed an Agreement for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income (Hereafter: the DTA).

Although the DTA has been signed, it has not entered into force yet. For the DTA to enter into force, the respective ratification procedures have to have been finalized in both countries.

Below we will discuss a selection of provisions included in the DTA of which we think they might interest our readers.

- Details

On May 26, 2016 the Court of Justice of the European Union (CJEU) judged in Case C‑550/14 Envirotec Denmark ApS versus Skatteministeren (ECLI:EU:C:2016:354).

Are ingots consisting of a random, rough fusion of various scrapped, gold-bearing metal objects covered by the terms ‘gold material or semi-manufactured products’ within the meaning of Article 198(2) of the VAT Directive?

It can be taken as established that the ingots consist of a random, rough fusion of various scrapped, gold-bearing metal objects and they can contain, in addition to gold, also organic materials, such as teeth, rubber, PVC and metals/materials such as copper, tin, nickel, amalgam, the remains of batteries containing mercury and lead, and various toxic substances, etc. There is thus no question of it being a gold-bearing product which is being processed directly into a finished product. On the other hand, the ingot is a processed product (a fusion), which — as a form of intermediate stage — is created with a view to extracting the gold content. The ingots have a high gold content, on average between 500 and 600 thousandths, and thus substantially over 325 thousandths gold. After extraction, the gold content is to be used to manufacture (gold/gold-bearing) products.

In answering the question, it can also be taken as established that the ingots cannot directly form part of other products, since first the ingots must be subjected to processing in which the metals are separated and the non-metals and hazardous substances etc., are melted away/excreted.

Page 1 of 4